The April 15 tax filing deadline is approaching. Learn how to safeguard yourself from IRS tax filing phishing scams that can compromise your personal information and financial security.

Understanding IRS Tax Filing Phishing Scams

Phishing scams are fraudulent attempts to obtain sensitive information, such as usernames, passwords, and credit card details, by disguising as a trustworthy entity.

IRS tax filing phishing scams specifically target individuals during tax season, when people are more likely to be submitting their tax returns online.

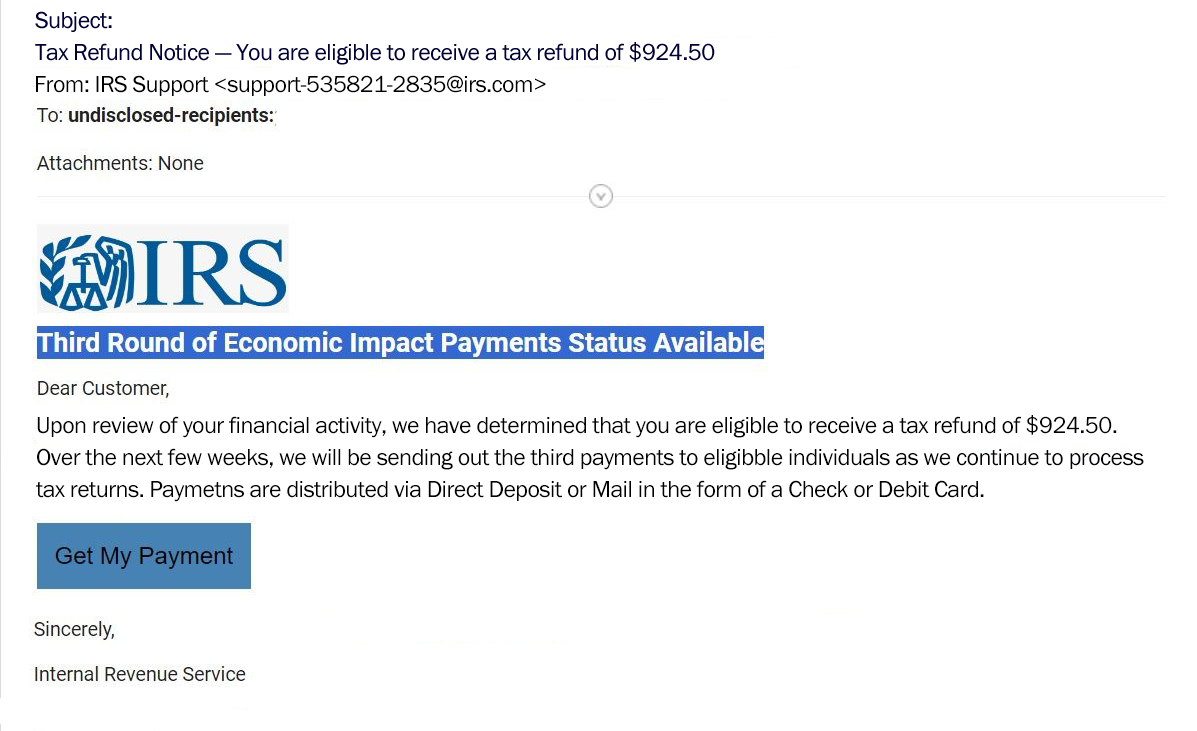

Scammers often send emails or create fake websites that appear to be from the IRS, requesting personal information or claiming there is an issue with the recipient's tax filing.

Other examples include:

- Unclaimed refund scams

- Employee Retention Credit scams

- Fake W-2 Form Scams

- Pandemic-related email scams

- Charity scams

- Scams targeting educational institutions

These tactics are constantly evolving, especially with the prevalence of AI to make phishing emails more convincing.

For more information on the latest tax scam phishing tactics for 2025, check out the Dirty Dozen Tax Scams list for 2025 on the IRS website.

Tax season scams can lead to identity theft, financial loss, and other serious consequences.

It is important to understand how these scams work in order to protect yourself from falling victim to them.

Recognizing Warning Signs of Phishing Scams

There are several warning signs that can help you identify a potential phishing scam:

- The email or website address does not match the official IRS domain (irs.gov)

- The email contains spelling or grammatical errors

- The email asks for personal information, such as your Social Security number or bank account details

- The email includes urgent requests or threats, such as fines or legal action if you do not provide the requested information

- The email or website looks suspicious or unprofessional

But don't rely on poor grammar or bogus-looking websites for clues. Websites can easily be cloned, and AI tools such as ChatGPT are making poorly-crafted phishing emails a relic of the past. By being vigilant and paying attention to these warning signs, however, you are less likely to fall for phishing scams.

Protecting Your Personal Information Online

To protect your personal information online and reduce the risk of falling victim to phishing scams, follow these best practices:

- Be cautious when sharing personal information online, especially on websites or platforms that are not secure or trustworthy

- Use strong, unique passwords for all your online accounts and enable two-factor authentication whenever possible

- Regularly update your computer, smartphone, and other devices with the latest security patches and antivirus software

- Be wary of clicking on links or downloading attachments from unknown or suspicious sources

- Educate yourself about phishing techniques and stay informed about the latest scams

By implementing these measures, you can significantly enhance your online security and protect your personal information from phishing attacks.

Tips for Safeguarding Against Phishing Attacks

In addition to protecting your personal information, here are some additional tips to protect yourself against phishing attacks:

- Verify the legitimacy of emails or websites by contacting the official organization directly through their official contact information

- Be skeptical of unsolicited emails or phone calls requesting personal information

- Hover over links in emails to see the actual URL before clicking on them

- Double-check the From address in email messages. These headers can easily be spoofed. MDaemon has a feature called From Header Screening that can help users more easily identify spoofed emails.

- Check for secure website indicators, such as a lock icon in the browser's address bar or an 'https://' prefix

- Regularly review your financial statements and credit reports for any suspicious activity

Reporting IRS Tax Filing Phishing Scams

If you encounter an IRS tax filing phishing scam or believe you have been targeted by one, it is important to report it to the appropriate authorities:

- Forward the suspicious email to the IRS at phishing@irs.gov

- Report the scam to the Federal Trade Commission (FTC) at ftc.gov/complaint

- If you provided your personal information, contact your financial institution and credit bureaus to protect your accounts and credit

The IRS has a variety of additional tips for avoiding online phishing scams on their website.

Reporting these scams helps authorities in their efforts to combat phishing and protect others from falling victim to similar schemes.

How Email Administrators can Help Protect Users from Phishing

While users play a crucial role in avoiding email scams, mail server administrators have an important role as well. Both MDaemon and SecurityGateway include a variety of anti-spam, anti-phishing and anti-abuse tools to help protect users from online threats. Both include a fully-functional 30-day free trial. Compare it to your current email security solution and if you have suggestions or feedback, feel free to leave us a comment below!